What Information Should be Reported in Form 941?

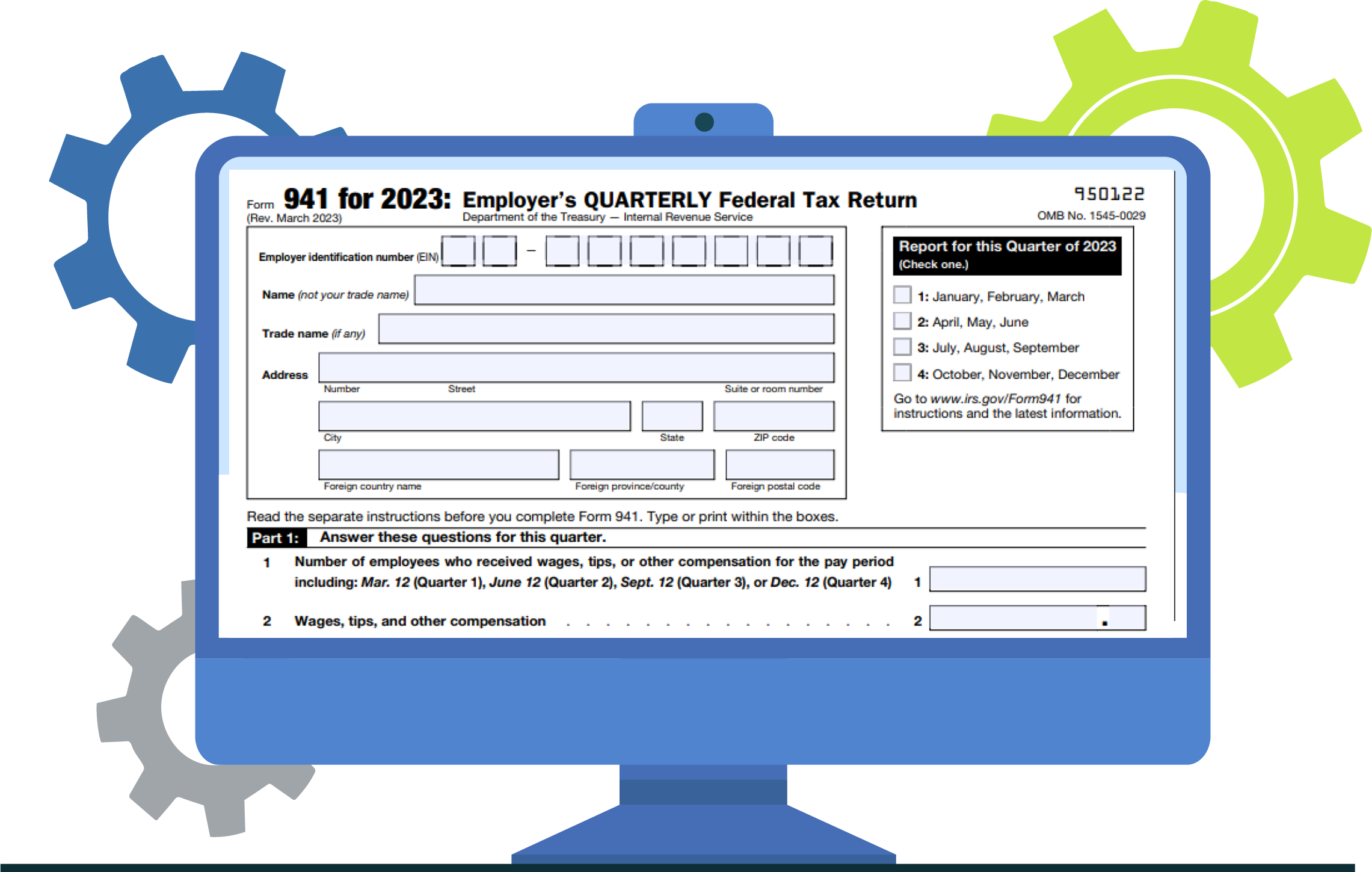

There are a few details that you need to keep handy before you begin filing, which include:

- Business information such as Name, EIN, and Address

- Total employee count

- Federal income tax withheld from employees

- Employer and employee share of FICA (Social Security and Medicare) taxes

- Tax deposits made to the IRS

- Tax liability for the quarter

Have these details ready? Start filing Form 941 for 2024 now.

E-File 941 NowBenefits of filing Quarterly Form 941 Online for 2024?

When you choose to e-file Form 941 , you will save a lot of time and money. In addition to this, here are the best benefits you’ll get when you e-file with us.

Quick & Secure Filing

File your Tax Form 941 securely and quickly with the help of our form-based filing interface and save a lot of time.

Instant IRS Approval

Get your return validated based on the IRS business rules and reduce the chances of a form rejection.

Form Validation

Get your return validated based on the IRS business rules and reduce the chances of a form rejection.

Download or Email Forms

Access your 941 return at any time from your account or even send it by email. Record keeping is made simple.

Form 941 online in minutes and get an instant approval from the IRS.

E-File 941 NowWhat is Form 941 Worksheet and why should you complete it?

Form 941 Worksheet is used to calculate the qualified sick and family leave wages and employee retention credit.

IRS revised the Form 941 Worksheet 1 for the 2nd quarter of 2021. According to this, the Step 3 in the Worksheet 1 is made into a separate Form 941 Worksheet 2 for 2nd quarter 2021 for calculating the employee retention credit on wages paid after March 31, 2021 and before July 1, 2021. Form 941 Worksheet 4 is for calculating employee retention credit for the third and fourth quarter. Other than these, Worksheet 3 and Worksheet 5 are added for the remaining quarters of 2021.

Visit https://www.taxbandits.com/form-941/what-is-form-941/ to learn more.

How to E-File Form 941 for 2024?

You can follow the below simple steps to E-file Form 941 easily and quickly.

Enter Form Information

Enter the form information such as business info, total employees, tax liabilities for the quarter, and tax deposits made in the quarter.

Review Form

Preview the draft 941 form and make sure you have entered the correct information and update if there are errors.

Transmit to the IRS

If everything looks good, transmit the return to the IRS. You will receive an email once the return is processed by the IRS.

Looks simple? Yes, we’ve made it simple for you!

E-File 941 NowWhen is the Quarterly Form 941 Due for 2024?

Tax Form 941 needs to be filed every quarter even if there are no wages or taxes to report for the quarter. Below are the

due dates for filing Form 941 :

Quarter 1

Jan, Feb, and Mar

April 30th, 2024

Quarter 2

Apr, May, and Jun

July 31st, 2024

Quarter 3

Jul, Aug, and Sep

October 31st, 2024

Quarter 4

Oct, Nov, and Dec

January 31st, 2025

What is the Penalty for Not Reporting Form 941 on time?

The IRS will impose 941 penalties if you fail to pay tax dues and file Form 941 for a quarter. Below are the penalties for not filing Form 941 on time:

- If you file Form 941 within 1 to 5 days after the deadline, there will be a penalty of 2% of the tax due amount.

- If you file Form 941 within 6 to 15 days after the deadline, there will be a penalty of 5% of the tax due amount.

- If you file Form 941 10 days after receiving notice from the IRS, there will be a penalty of 15% of the tax due amount.

Helpful Resources for Filing Quarterly Form 941

Understanding Form 941

Get to know about the definition, purpose, and due dates of Form 941 in detail.

Learn moreForm 941 Instructions

Learn the step-by-step instructions for filing Form 941 with the IRS.

Learn moreForm 941 Due Date

Get to know about the deadlines to file Form 941 and how to avoid penalties.

Learn moreFrequently Asked Questions on Form 941

- What is Form 941?

- What are the advantages of e-filing Form 941?

- Can I pay the tax due while filing my Form 941?

- What is Zero Reporting in Form 941? View More FAQs

File 941 Reporting Online for 2024?

E-file Form 941 in less than 5 minutes and get an instant approval from the IRS.

E-File 941 NowLowest Price ($5.95/form)

Simplify Your Year-End Reporting: File Form W-2 with Ease

Simplify your year-end reporting by easily filing Form W-2 online. The process ensures accuracy and helps you stay compliant with IRS requirements, all while saving time. With clear instructions, you can quickly generate and submit your W-2 forms, reducing the risk of errors.

E-File Form W-2 NowIn need of pay stub generation for proof of income or employment?

Our intuitive paystub generator instantly calculates and generates pay stubs you can effortlessly

download, print, and share.